Bringing you a leading digital platform with a human touch

Our mission at iX-7 Asset Management SA is to maintain and grow your assets, outperforming the market while minimizing risk. We do this by combining the latest technology with in-depth investment experience and know-how. We deliver high performance via a conservative asset management approach that takes advantage of technology’s speed and precision, while still keeping the human touch..

Our comprehensive research factors in rising trends in price, in addition to industry and vertical factors, ensuring that you receive data-driven advice seasoned with industry experience. We focus on companies that deliver high-value services to their customers; and we do the same, offering both advisory services and fully-fledged strategies that range from low-risk to complex.

Find Your Risk Profile

Taking All Your Needs Into Account

Fast-Track Investment Advice

To obtain your personalized recommendations, select your custom requirements:

Make Outperformance Happening

Next Generation Investing

The Next Generation investment philosophy is a fully equity-based strategy. Investors gain access to winning structural trends, embedded in our investment philosophy and process.

Tailor-Made Strategies

Our asset allocation process is supported by Artificial Intelligence (AI), and is suitable for both private and institutional investors who wish to delve into each individual asset class.

Please consult our web site for important [disclaimers] and [investor disclosures] concerning iX-7 Asset Management SA‘s investment research concept.

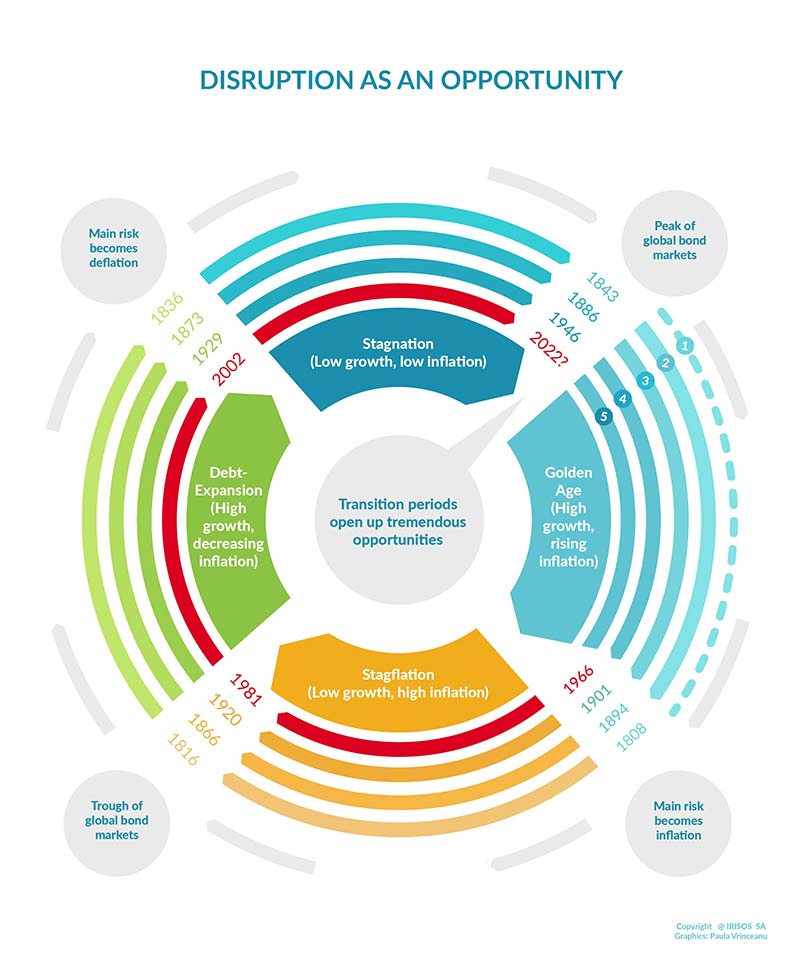

DISRUPTION AS OPPORTUNITY

Managers need a sustainable edge to beat the market over a given period.

How it works: Active factor managers use a factor model to crystallize the best possible investment opportunities within a given investment universe or economic trend.

Our key assumption: Technology-driven companies, which maximize substantial value-add to their products and services, have a fundamental edge over traditional companies, especially as the Digital Age Transformation nears. These tech companies are poised to perform better than the average market.

The Science Behind the Model

SELECTION AND ASSESSMENT METRICS:

Using 17 criteria, each stock is ranked against other stocks within a respective investment theme, the worst stock receiving a 0% ranking and the best stock receiving a 100% ranking.

The criteria are grouped according to:

- Valuation

- Growth

- Momentum

- Risk

- Online reputation, and brand score

Strategies can run at equally weighted values or according to on-demand ratios.

Ready to get started

WHAT I AM LOOKING FOR

Our Products and Services

ROI

DISRUPTION AS OPPORTUNITY

Take it to the next level: