Bringing you a leading digital platform with a human touch

Our mission at iX-7 Asset Management SA is to maintain and grow your assets, outperforming the market while minimizing risk. We do this by combining the latest technology with in-depth investment experience and know-how. We deliver high performance via a conservative asset management approach that takes advantage of technology’s speed and precision, while still keeping the human touch..

Our comprehensive research factors in rising trends in price, in addition to industry and vertical factors, ensuring that you receive data-driven advice seasoned with industry experience. We focus on companies that deliver high-value services to their customers; and we do the same, offering both advisory services and fully-fledged strategies that range from low-risk to complex.

The leading Swiss digital investing platform

The leading Swiss digital investing platform

ASSET ALLOCATIONS

Taking All Your Needs Into Account

Fast-Track Investment Advice

To obtain your personalized recommendations, select your custom requirements:

Make Outperformance Happening

Next Generation Investing

The Next Generation investment philosophy is a fully equity-based strategy. Investors gain access to winning structural trends, embedded in our investment philosophy and process.

Tailor-Made Strategies

Our asset allocation process is supported by Artificial Intelligence (AI), and is suitable for both private and institutional investors who wish to delve into each individual asset class.

Please consult our web site for important [disclaimers] and [investor disclosures] concerning iX-7 Asset Management SA‘s investment research concept.

Personalized Advice Using Artificial Intelligence

Personalized Advice using Artificial Intelligence

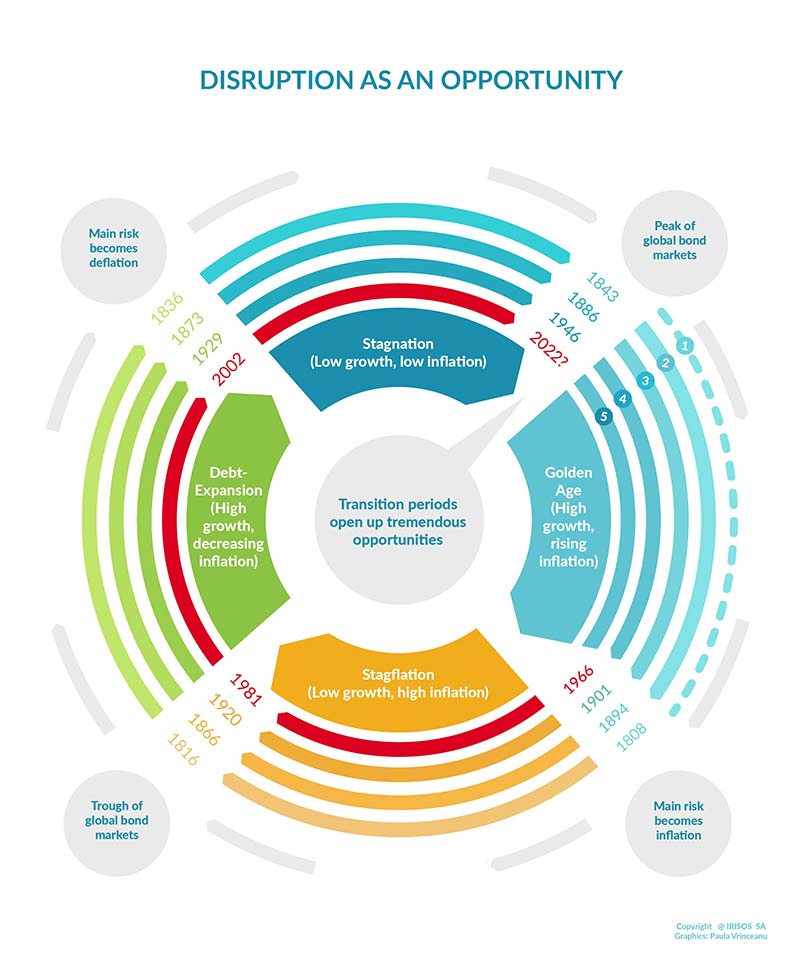

DISRUPTION AS OPPORTUNITY

Managers need a sustainable edge to beat the market over a given period.

How it works: Active factor managers use a factor model to crystallize the best possible investment opportunities within a given investment universe or economic trend.

Our key assumption: Technology-driven companies, which maximize substantial value-add to their products and services, have a fundamental edge over traditional companies, especially as the Digital Age Transformation nears. These tech companies are poised to perform better than the average market.

The Science Behind the Model

The Science Behind the Model

SELECTION AND ASSESSMENT METRICS:

Using 17 criteria, each stock is ranked against other stocks within a respective investment theme, the worst stock receiving a 0% ranking and the best stock receiving a 100% ranking.

The criteria are grouped according to:

- Valuation

- Growth

- Momentum

- Risk

- Online reputation, and brand score

Strategies can run at equally weighted values or according to on-demand ratios.

Ready to get started

Ready to get started

WHAT I AM LOOKING FOR

Our Products and Services

Management

Our Experience and Knowledge = Your Success

Meet our Management Team: Setting the pace for innovation and performance.

Christoph A. SCHMID

CEO

Salman AL AMERI

COO

Osama KAMEL

Head of Sales

Roman SHEVCHENKO

Lead Developer

CHRISTOPH A. SCHMID

CEO

An elite senior banking expert with over 30 years of experience, Christoph has amassed extensive IT and banking expertise during his international career.

Visionary in terms of business, Christoph is a leader in engineering products that intersect with economic realities, synthesizing user requirements, banking needs, and IT expertise. Annual average dealing making: in excess of $1.5 billion.

Salman AL AMERI

COO

As organizational leader, Salman diffuses the company’s vision from within. He brings extensive leadership experience to the role in the areas of management, decision making and problem solving, bringing his visionary, forward-looking perspective to the fore.

Osama KAMEL

Head of Sales

Osama has over 15 years of experience in wealth management and private banking, and an educational background in Business Administration and the Information of Systems.

His specialty is strategic financial planning, developing complex financial products and structuring diverse investment portfolios for UHNWIs.

Lead Developer

Roman is an IT expert specializing in new technologies and development trends.

He has successfully spearheaded new complex technologies, navigating implementation of technological advances through his technical leadership and mentorship of our QA and development teams.

Who We Are

Our mission at iX-7 Asset Management SA is to maintain and grow your assets, outperforming the market while minimizing risk. We do this by combining the latest technology with in-depth investment experience and know-how. We deliver high performance via a conservative asset management approach that takes advantage of technology’s speed and precision, while still keeping the human touch.

About Us

iX-7 Asset Management SA was founded in 2011 by independent asset manager Christophe Schmid in Nyon, Switzerland. The company specializes as an active equity manager; in particular, it centers investment expertise and know-how on companies with a strong exposure to the 4th industrial revolution and new technologies.

We strongly believe in the benefits of artificial intelligence and the systematic analysis of data and information. At iX-7 Asset Management SA, our asset management strategy benefits from the cross-pollination of personal skills, know-how and competences, as well as the latest information technologies.

Independence

We are a Swiss-based independent asset management company with our own tailor-made IT infrastructure. Our strategies are actively managed and are aimed at creating ALPHA. Our investment decision-making process works outside of any kind of conflicts of interest; the facts and figures analyzed translate directly into your preferred investment strategy.

Expertise

If you are looking for an actively managed equity investment solution, we have the expertise. The indexation of your investments no longer deserves your attention; these strategies are outdated and have become highly risky. In contrast, our expertise results in a conservative portfolio set-up, based on the evolution of the fundamentals of the companies we invest in, top-down figures, and geopolitical and macroeconomic aspects.

Security

Our mission is to manage and grow your assets. To do so, we have selected different service providers with careful due diligence. Your agreed-upon strategy is monitored continuously on your behalf, with every tool and means available to us.

Performance

Performance achievement is at the heart of our goals. We aim at creating outperformance (Alpha), while maintaining risk within highly conservative parameters.

DISRUPTION AS OPPORTUNITY

Take it to the next level: